Investor News

Gas pricing in the news

Last week, The Australian newspaper and the industry journal Platts Coal Trader International led reports of a reversal in Australian energy sector trends. The Age also joined the chorus with an article yesterday.

The message:

The Queensland generator Stanwell Corp. has chosen to restart its previously idled coal-fired Tarong generating unit while withdrawing its gas-fired Swanbank E unit from service due to rising natural gas prices driven by demand from Asia and a very competitive thermal coal market.

The economic drivers are clear.

Stanwell advised they will be able to create significant financial benefits by providing lower marginal cost electricity from their Tarong plant while selling their gas allocations from the curtailed Swanbank E unit.

Essentially, exporting the gas is more profitable than using it for electricity generation here.

As the domestic electricity market sits, the margin on coal-based electricity generation outperforms its gas-based counterpart.

This double lift for Stanwell is delivering a higher margin for both businesses.

This is not an isolated event. The article in The Australian newspaper noted that this trend of coal-fired generation returning to service and displacing other generating means is gaining momentum in such advanced economies as Germany. It noted, "Germany is shifting back to more coal-fired electricity generation, reopening some of its dirtiest brown-coal mines that have been closed since reunification, despite having spearheaded Europe's push into renewable energy."

While these trends signal an increasing focus on the economic cost of electricity generation, thankfully, it does not appear to mean a return to the carefree attitudes of decades past for CO2 emissions. On the contrary, the energy market is becoming more flexible, focusing on cost and a balanced approach covering cost and emissions intensity.

ECT views this growing maturity as an opportunity for Coldry technology deployment in those advanced economies, which ECT is preparing to approach as we advance our demonstration program in India.

Opportunities for advanced lignite utilisation become increasingly viable in light of an increased gas price.

In this context, Coldry can act as the ideal gateway technology, a cost-effective enabler of downstream upgrading processes that can see the likes of Victoria’s world-class lignite resource used to underpin economic security, energy security, and climate security.

Lignite can be cost-effectively gasified if dried efficiently using the Coldry process, providing an alternative to natural gas for long-term energy security in markets with lignite reserves.

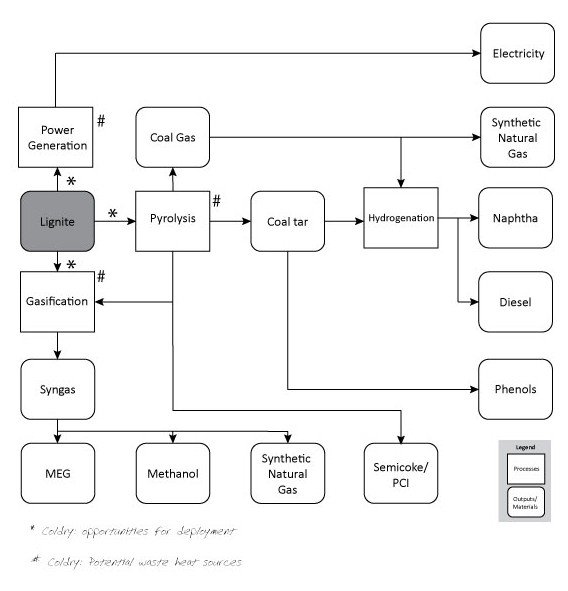

The diagram below illustrates the typical upgrade path for lignite and the opportunities for Coldry.