Investor News

HIsarna, like HiSmelt not a threat to HydroMOR

HiSmelt, and a related technology known as HIsarna, have made the headlines recently:

Tata Steel reveals HIsarna technology to tackle environmental concerns in the steel industry[i]

We recently wrote about HiSmelt, noting it wasn’t a direct threat to HydroMOR development due to the unique value proposition of HydroMOR; its ability to use lignite instead of coking coal or thermal coal, in combination with iron ore fines.

The same applies when comparing HydroMOR to HIsarna.

HIsarna

HIsarna is HiSmelt with the addition of a cyclone converter furnace (CCF).

Key points from the above article:

- Pilot plant capacity ~60,000 tonnes of liquid iron per annum

- Location: Ijmuiden, Netherlands

- Process: Direct reduction of iron ore fines with thermal (black) coal

- Advantages compared to traditional Blast Furnace:

- 20% improvement in energy efficiency

- 20% reduction in carbon emissions across steel making process

- Future demonstration-scale plant planned (0.5 – 1.0 million tpa) at a cost of AUD487-AUD570M

You can find further background on Tata’s website[ii].

In short, as with our comments on HiSmelt, we do not believe HIsarna is a direct threat to HydroMOR in markets with suitable lignite resources. However, we’ve been unable to find any reliable, publicly available information on the anticipated capital or operating costs of a commercial HIsarna plant, so it’s difficult to make a straightforward commercial comparison. This is not unusual for technologies still under development.

In the absence of sufficient data, it’s helpful to ask what problem or problems the new process seeks to solve?

To understand the problems, it’s handy to have a little background.

The underlying chemistry for the incumbent ‘blast furnace’ route is carbon-based and has been around since the advent of coke-based iron-making in 1709, benefitting from refinement and scale improvements over time, to become the dominant primary iron-making process globally.

The blast furnace route relies on a diet of premium grade black coal, known as coking or metallurgical coal and premium grade lump iron ore. This narrow raw material specification results in the following challenges:

- Economic Security

- Energy & Resource Security

- Environmental Security

Let’s take a brief look at each.

Economic Security

Both coking coal and premium lump iron ore attract a price premium compared to thermal coal, lignite and lower grade lump ore and iron ore fines.

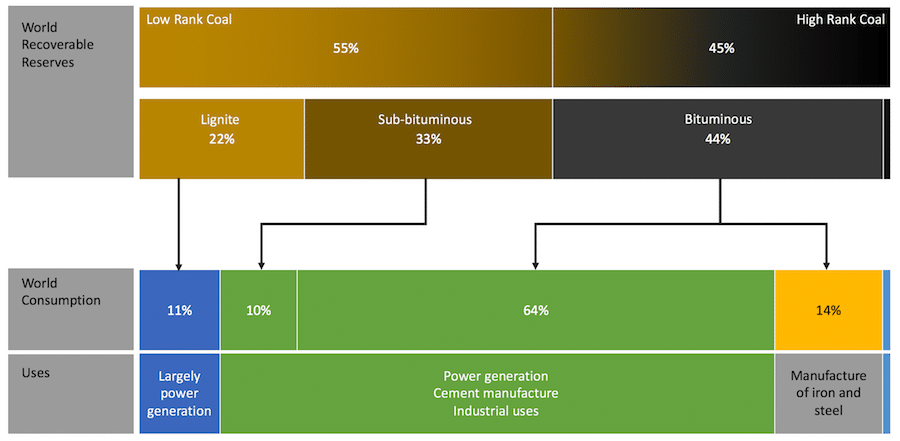

Globally, high-rank coal accounts for 80% of coal consumption yet only represents 45% of recoverable resources.

Lignite represents 22% of recoverable resources and only 11% of consumption.

Countries with insufficient quantity or quality of domestic reserves need to import one or both of these key resources, resulting in currency outflows.

Energy & Resource Security

India ranks 5th in iron ore reserves and 4th in iron ore production yet imports of iron ore are rising due to the mismatch between the grades available domestically and the requirements of the steel mills. The bulk of increased domestic production is lower-grade fines rather than lump iron ore needed by blast furnaces[iii].

Fines can be used if they are briquetted and sintered, but this adds cost.

Coking coal is expensive. India has limited domestic coking coal reserves, relying heavily on imports.

Environmental Security

The two primary environmental concerns are the accumulation of iron ore fines, taking up large swathes of land and the CO2 intensity of the steelmaking process.

Finding Solutions

With the above in mind, the main aim of any new iron-making process is to provide an economically sustainable solution to some or all of the above problems.

Let’s consider these factors in light of India’s ambition to triple steelmaking capacity from 100 to 300 million tonnes a year by 2030.

Given India has little domestic coking coal, a key part of its national strategy to mitigate imports is to deploy technology that can utilise domestic resources, including thermal coal and lignite.

India also has a problem with its iron ore. It’s soft, producing around 30% fines. Reports indicate India has around 150 million tonnes of stockpiled iron ore fines[iv].

In this context, a diversified approach to expanding its capacity must include the deployment of processes that can utilise fines, preferably without costly upgrading.

In places with thermal coal and iron ore fines, HIsarna or HiSmelt may be considered. In places with access to suitable lignite, we believe HydroMOR will become an obvious choice.

However, where HiSmelt and HIsarna may compete with each other and indeed with other black coal-based processes, HydroMOR is the only process under development that can utilise the cheapest form of coal; lignite.

And, as highlighted in our previous article, HydroMOR employs a hydrogen-based reduction reaction, whereas the Blast Furnace, HiSmelt and HIsarna are carbon-based reduction reactions.

In practical terms, our hydrogen-based process results in lower temperatures, which lower capital intensity and operating expense.

On the topic of CO2, HIsarna claims to be 20% less CO2 intensive than a blast furnace.

HydroMOR’s CO2 intensity compared to a blast furnace is estimated to be less than 70% of blast furnace emissions.

Assuming the above outcomes hold up through the pilot stage and subsequent scale-up, HydroMOR will deliver a lower CO2 footprint than HISarna.

As the only lignite-based process, we expect HydroMOR will allow customers with access to lignite resources to decouple from the metallurgical and thermal coal markets, increasing resource diversity and security.

HIsarna is tied to the thermal coal market.

We anticipate HydroMOR’s features will result in such benefits as lower capital intensity and operating expense compared to both HIsarna and HiSmelt, providing a convincing business case for broad adoption in markets with lignite reserves.

References:

[i] https://commodityinside.com/tata-steel-reveals-hisarna-technology-to-tackle-environmental-concerns-in-the-steel-industry/

[ii] https://www.tatasteeleurope.com/static_files/Downloads/Corporate/About%20us/hisarna%20factsheet.pdf

[iii] http://www.miningweekly.com/article/indian-iron-ore-production-and-imports-to-rise-in-current-fy-2018-03-26

[iv] http://www.miningweekly.com/article/indian-iron-ore-production-at-7-year-high-but-unsold-low-grade-stocks-pile-up-2018-05-08