Investor News

Hydrogen 'omissions'?

TL;DR:

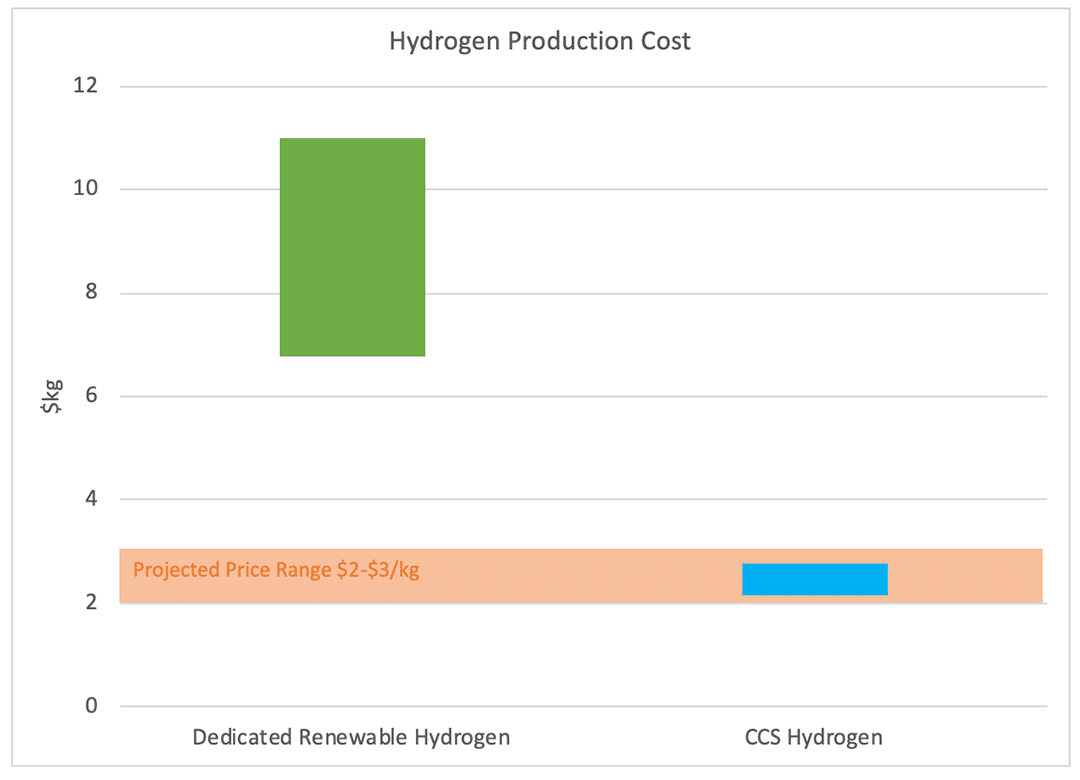

- The hydrogen export market price is forecast to be $2-$3kg in 2030

- Dedicated renewable hydrogen, made using electricity generated by wind and solar is estimated at $11kg, and projected to drop to $6.79kg, making it uneconomic

- CCS hydrogen made using brown coal is estimated to cost between $2.14kg-$2.74kg, well within the forecast hydrogen price range

- This information is often being omitted from news reports

- This newswire highlights the issue and arms you with the data you need to fill in the missing pieces

Parts of the media are omitting important information when they present news about Australia’s fledgling hydrogen industry.

An example is yesterday’s article in The Age titled 'Battlelines drawn over Australia's hydrogen fork in the road' (link at bottom of this page).

The article reported that a 'potential stoush is brewing over the future source of energy to power Australia's prospective hydrogen exports'.

The tone and content of the article aim to garner support for dedicated renewable hydrogen generation while omitting important information that shows it to be economically unsustainable.

Now, there’s nothing wrong with writing an opinion piece. But this article in The Age is presented as news. And Journalism is about presenting the facts to inform the reader. When journalists omit facts from an article, that’s an omission designed to manipulate rather than inform.

And given the current campaign by the media on 'your right to know', it certainly raises questions.

Is this type of omission a form of censorship and manipulation? If so, what are they hiding? What don't they want you to know?

Answer: Cost.

The article is correct, we are at a ‘fork in the road’. And there is a battle line. It’s just not the battle line they would lead you to believe.

Tomorrow, Australia’s Chief Scientist Alan Finkel will talk about the National Hydrogen Strategy at the COAG Energy Council meeting.

Based on the National Hydrogen Roadmap, and informed by recent public consultation, he’ll present two distinct routes ahead:

1) CCS Hydrogen

Based on the gasification of coal (black or brown), coupled with a process called steam reforming and integrated with CO2 capture and storage (CCS).

2) Renewable Hydrogen

Based on adding dedicated wind and solar capacity to generate electricity to split water (electrolysis) to make hydrogen.

This is the real issue.

Finkel knows from the data that brown coal-based CCS hydrogen generation is the most affordable route. And this undermines the one-eyed view of wind and solar advocates.

The above chart shows the projected cost of hydrogen according to the CSIRO’s National Hydrogen Roadmap.

On the left in green is the projected cost range for dedicated renewable hydrogen generation.

On the right is the projected cost range of CCS hydrogen from brown coal.

The orange shaded area is the projected market price for hydrogen in 2030.

Bottom line: $11kg may drop to $6.79kg.

Well above the target price range of $2-$3kg.

When put like this, it's clear why wind and solar advocates omit the information.

Now, we're not journalists, but we did what we thought a good journalist might do; we asked 'how much?'

It only took a quick scratch below the surface of the National Hydrogen Roadmap to quickly find the cost data.

So, let's revisit that 'battleline' in the context of what we now know about cost.

You're presented with the following 'fork in the road':

- CCS hydrogen at $2.14 to $2.74kg

- Dedicated renewable hydrogen at (maybe, generously) $6.79kg

The cost of dedicated renewable hydrogen needs to drop by more than half again to meet the projected market price of $2-$3kg.

CCS hydrogen is well within reach. Dedicated renewable hydrogen isn’t.

So, the ‘battleline’ reference in the article headline below is actually between 'expensive' and 'affordable' hydrogen.

So, remember, if you read an article promoting dedicated renewable hydrogen and it fails to mention the cost, you'll know it’s intentionally omitting information because the data is available and there’s no excuse for journalists ignoring your right to know.

For those with limited time or attention, feel free to stop reading here. You have the data. You now understand the bottom line.

For those interested in peeking further behind the curtain, please read on.

A brief breakdown of the cost and scale challenge of dedicated renewable hydrogen

Background

The National Hydrogen Roadmap outlines the projected export scenario through to 2030, suggesting a potential export market from Australia of 502,133 tonnes per annum, with a projected market price in 2030 of $2-$3 per kilogram, excluding storage and transport.

Let’s use this to assess the scale challenge.

- Meeting this demand with solar:

- New solar capacity of 10,274MW (we presently have ~13,000MW)

- Land required: 28,798 hectares (almost 14,400 Melbourne Cricket Grounds).

- Meeting this demand with wind:

- New wind capacity of 7,339MW (we presently have ~6,141MW)

- Land required: 46 hectares is quoted, but this is 'direct land use and assumes co-use with activities like grazing. The actual wind farm area required by the new wind capacity to allow for spacing between turbines is ~20 hectares per MW, requiring 146,780 Hectares.

We need to nearly duplicate our entire wind or solar capacity to service a 500,000 tonne per annum export opportunity. Not impossible, but we need to be upfront and let the community know the scale and cost.

What isn't included in the Roadmap is cost assumptions around the use of desalinated water, the cost impact of locating solar farms in areas of high solar resource (inland) away from production and export facilities (costal).

Are the assumptions reasonable?

As we scratched the surface of the data in the Roadmap a couple of assumption figures seemed odd. They didn’t match reality.

One case in point is the assumption of average electricity cost.

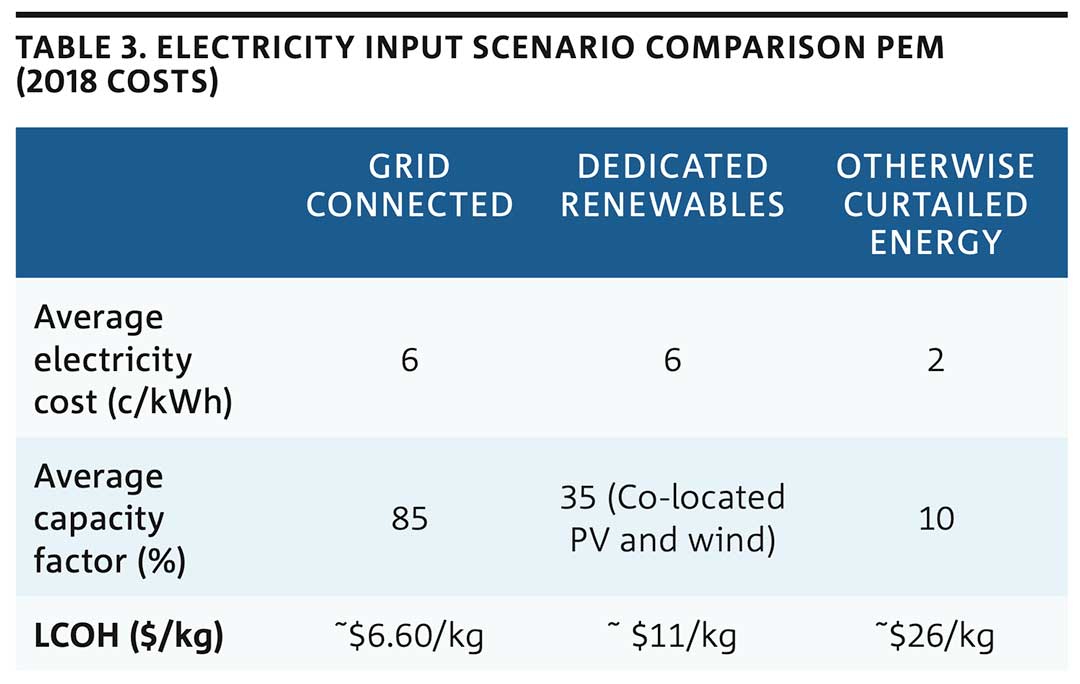

The following table from the Roadmap provides a cost estimate for renewable hydrogen under three scenarios.

A price of 6c/kWh is used for the first two.

Table 3. Electricity input scenario comparison PEM

CCS hydrogen is currently estimated to cost around $2.57-$3.14 (black coal) and $2.14-$2.74 (brown coal) at commercial scale.

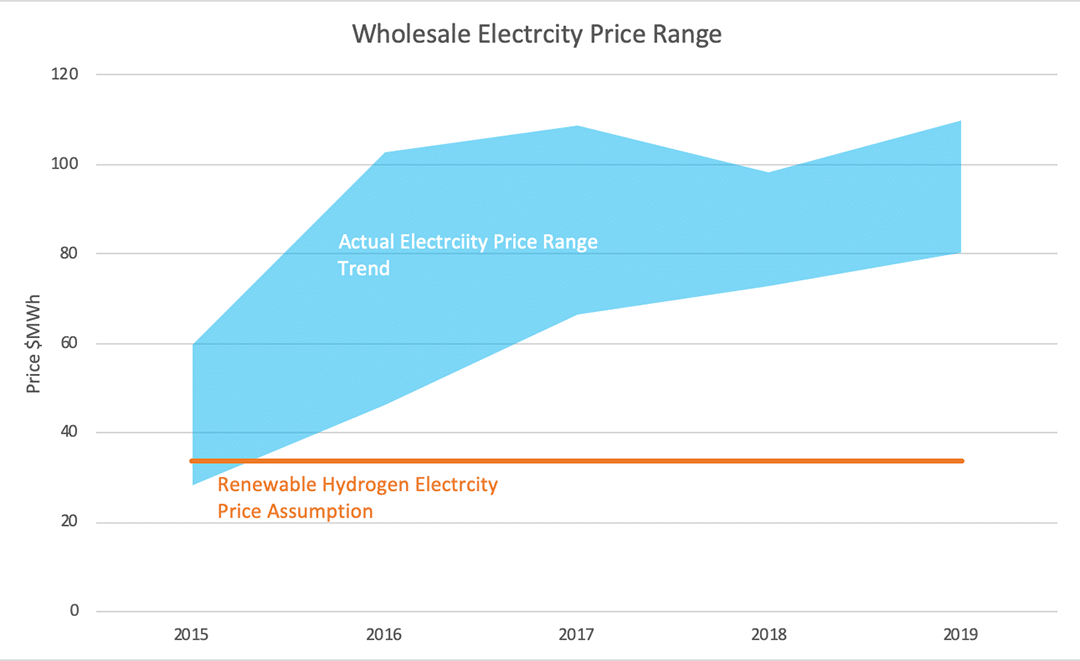

Is 6c/kWh realistic?

The answer is important because it lets us know if grid-connected hydrogen, which is shown as cheaper than dedicated renewable hydrogen, can realistically drop in cost to between $2 and $3kg.

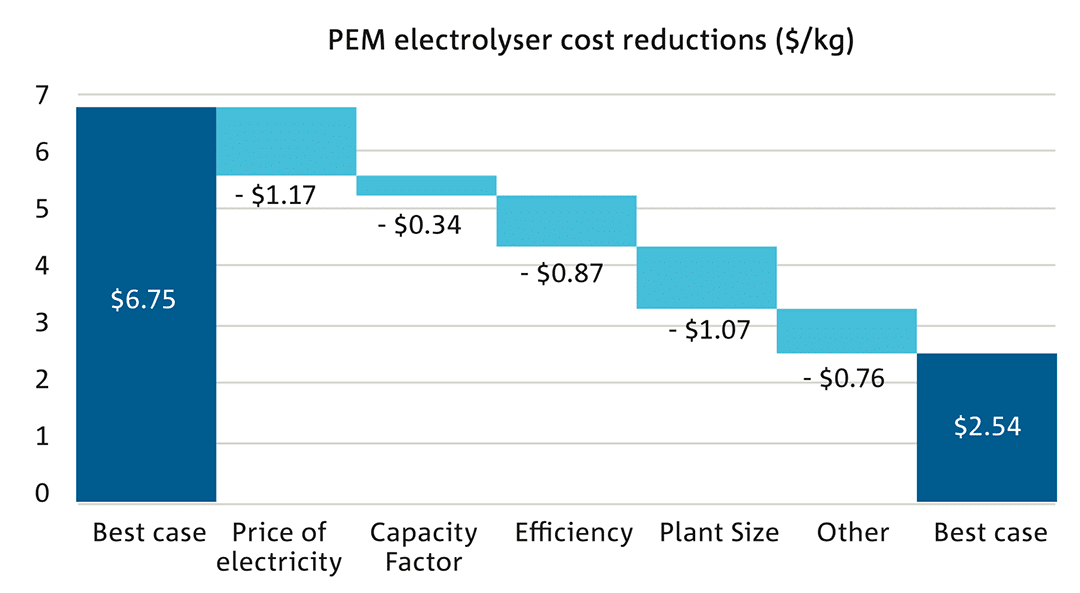

Setting aside the fact that the above table tells us the best case base cost of hydrogen production via electrolysis utilising electricity from the grid is $6.60 and the below table quotes $6.75, let’s examine the biggest component of project cost reduction; price of electricity.

Firstly, the lowest electricity price in the NEM at present is 6.5c/kWh in coal power-dominated Queensland. Elsewhere it ranges from 7c to 9.5c. So, that assumption is below the current lowest market price. It doesn't match reality.

Second, the chart assumes electricity prices will drop by $1.17/kg. This is important to unpack because it lets us know what has to happen for grid-connected renewable hydrogen to become competitive, allowing us to understand what also needs to happen to dedicated renewable hydrogen production costs to also become competitive.

We need two pieces of info to analyse this drop in the price of electricity:

- Electricity required to make 1kg of hydrogen: 50kWh;

- the grid-connected electricity price: 6c/kWh

Take 50kWh and multiply by 6c and you get $3 of electricity per kg of hydrogen as the starting point (ignore for the purpose of this exercise that 6c is already optimistically below the current market wholesale price).

To achieve the $1.17 reduction requires a 39% reduction in the cost of electricity, from 6c to 3.66c/kWh.

There is nothing in the data or energy policy settings that indicate this is likely or how it may be achieved. It's unfounded.

As shown in the chart below, the last time we had wholesale electricity prices that low was in 2015, before we started closing coal power stations and adding more wind and solar.

Unfortunately, the Roadmap doesn't show the same cost curve for dedicated 'renewable hydrogen' production, so we can only extrapolate.

Firstly, the assumption of the current electricity price of 6c is the same for dedicated renewable hydrogen as it is for grid-connected hydrogen (table 3.1 above). The main difference is the capacity factor, which is unlikely to change much. On this basis, let's apply the same cost reduction rationale of $4.21.

Starting at $11kg, take away $4.21 and you get $6.79.

More than double the projected upper market price of $3kg for hydrogen in 2030.

Now, there may be some breakthrough in the pipeline that changes all that. But failing an unknown breakthrough in the near term, the cost of dedicated renewable hydrogen is too high. We need CCS hydrogen to bridge the gap in affordability if we're to successfully compete on the world stage.

Battlelines drawn over Australia's hydrogen 'fork in the road'

20 Nov 2019 | The Age | Peter Hannam and Mike Foley

A potential stoush is brewing over the future source of energy to power Australia's prospective hydrogen exports, with several states lining up to support renewables over coal at this Friday's energy ministers summit in Perth.

Chief Scientist Alan Finkel will kick off the COAG energy council meeting - the only such gathering in 2019 - with a presentation on Australia's National Hydrogen Strategy, according to a copy of the agenda obtained by The Sydney Morning Herald and The Age...

Source: Battlelines drawn over Australia's hydrogen 'fork in the road'