Investor News

Shareholder Update - India Activity

Environmental Clean Technologies Limited (ASX: ECT) (ECT or Company) is pleased to provide the following update on current India activity.

Key points:

- Market research on potential India steel industry partners complete

- Prospect engagement underway

- NLC India Limited (NLCIL) remain engaged and supportive

- HydroMOR pilot project assessment indicates significant potential savings since the initial basic design was completed in March 2018

ECT is poised to actively continue the commercialisation program for its HydroMOR process (formerly Matmor process) in India.

HydroMOR is a unique and innovative brown coal-based, hydrogen-driven iron making technology.

Following the stalling of the Company’s proposed India project mid last year, a new steel industry partner is being sought to drive the development of the HydroMOR pilot-scale demonstration project ahead of commercial scale-up and broader market rollout.

In support of this objective, the Company has pursued initial, informal discussions with several steel industry counterparties in India over the past several months.

Following the recent conclusion of a detailed market study, efforts to move toward a formal engagement with these potential partners for a new HydroMOR project will start in earnest upon completion of the current entitlement issue capital raising, due to close on 30 January 2020.

NLCIL remain engaged and supportive and continue to be a critical partner in supplying lignite to any future HydroMOR project.

India Market Research – Broadening the potential customer base

The Company has invested considerable resources developing an India project focused on demonstrating its technologies ahead of commercial rollout.

India’s largest lignite miner, NLCIL, remain supportive though a steel industry partner is required for them to proceed.

To this end, ECT has identified four key players, broadening its prospect base:

|

Company |

INSTALLED CAPACITY (MTPA) |

SALEABLE STEEL (MTPA) |

MILL SCALE GENERATION |

MILL SCALE AVAILABILITY (MTPA) |

|

SAIL |

21.0 |

~17.0 |

~1.0 |

~0.5 |

|

RINL |

7.3 |

~5.5 |

~0.33 |

~0.33 |

|

JSW |

18 |

~16 |

~1.0 |

~0.5 |

|

TATA STEEL |

16 |

~10 |

~0.6 |

~0.6 |

|

Total |

62.3 |

~ 48.5 |

~2.93 |

~1.93 |

Targeting India’s ‘above-ground ore body’

The above parties produce almost 3 million tonnes per annum of millscale waste, representing an ‘above-ground ore body’ with a potential iron yield of ~1.9 million tonnes per annum, or ~4% lift in saleable steel output, if reclaimed through HydroMOR processing.

In addition to millscale, there are stockpiles of inferior grade iron ore fines and slimes at mines across India estimated at being well over 100 million tonnes, accruing at an estimated rate of up to 20 million tonnes per annum.

At present, ECT is in early discussions with several of the above parties noting that RINL, which is in joint venture talks with South Korea’s POSCO, is presently unavailable to engage.

This early engagement, led by ECT India Chairman-Managing Director and former NLCIL Director P. Selvakumar, has involved the introduction of the Company and its technologies and has set the groundwork for ongoing discussions with the view to developing commercial projects.

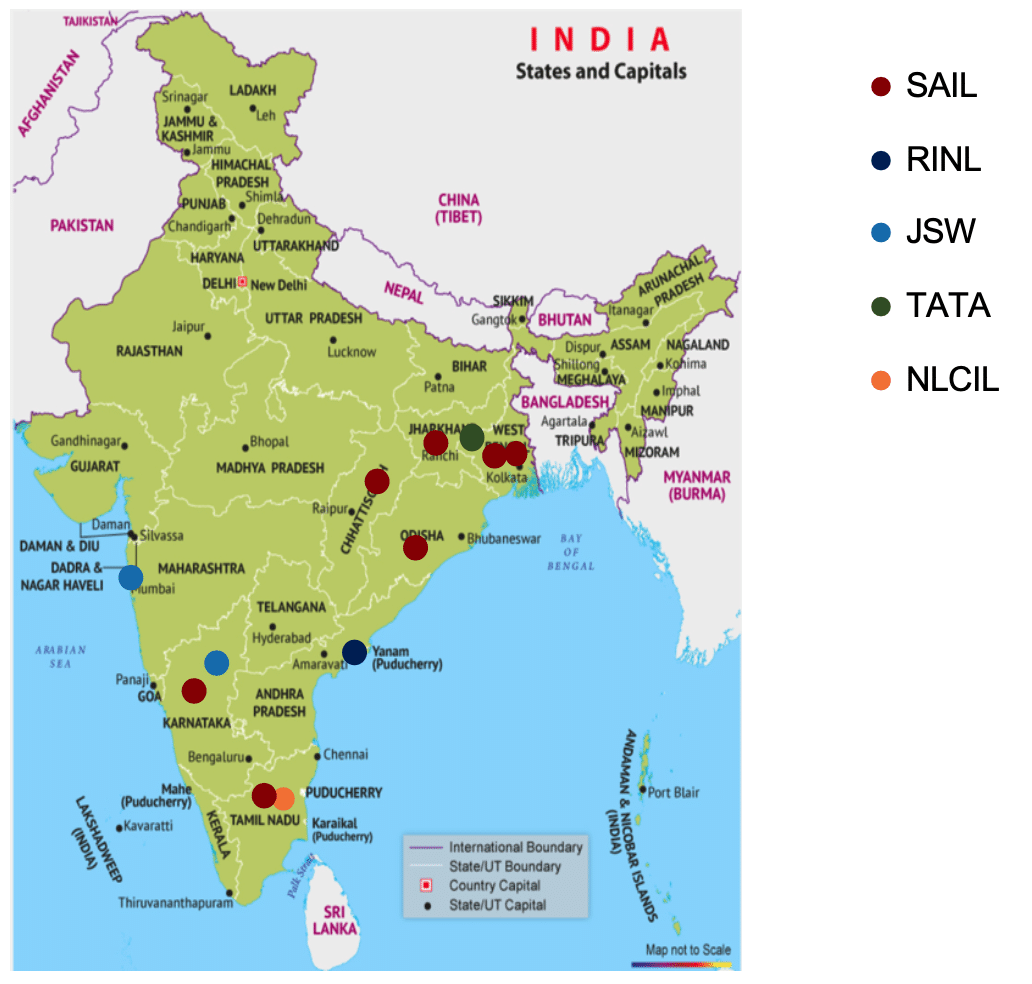

Key Steel Plant Locations relative to NLCIL

Commercialisation Strategy

The initial India project focused heavily on the challenge of funding the pilot phase, ahead of commercial scale-up.

The location of the pilot plant was another important aspect, with NLCIL agreeing to host the project adjacent to their mine and power station complex at Neyveli in the state of Tamil Nadu.

The proposed partners for the initial project were government-controlled entities. As such, the corporate structure established for executing the India project entailed a partnership approach whereby the partners would benefit via an ownership stake from the subsequent global commercial roll-out of HydroMOR across India by other steelmakers.

Based on the market research conducted over recent months, this approach may not suit privately-owned steelmakers, requiring a modified framework.

ECT Chief Engineer Mr Ashley Moore commented, “Initial market analysis indicates the logistics favours the movement of lignite to existing steelmaking facilities when dealing with multiple, geographically distributed operations.

“How we proceed through the pilot phase will depend on which party or parties may decide to partner with us to develop the pilot plant, or alternatively seek to build a commercial HydroMOR solution following the pilot plant demonstration phase.

“We’ll seek to ascertain as early as possible whether the parties have an appetite and mandate to invest in the pilot phase.

“Importantly, we’ll seek to understand if they require some form of subsequent commercial phase exclusivity in return for their pilot phase investment.

“This particular point is important as we would prefer not to limit our ability to offer HydroMOR to the broader India market. Our options are to either conduct the pilot phase at NLCIL’s site, as originally intended, or at our existing Melbourne research facility, thereby leveraging the planned upgrade of the Coldry high volume test facility. Locating the HydroMOR pilot plant in Australia would cost more for the HydroMOR component, but it would allow us to provide testing across a range of raw materials from multiple potential customers without the conflict.

“Further, we’ve also been able to refine aspects of the HydroMOR pilot project basic design completed in March 2018, resulting in potentially substantial capital savings.

“While these details will need to be refined as we step through our potential engagement with the parties over coming months, the value proposition is clear and compelling; HydroMOR enables the profitable upgrading of low-value and waste iron oxide sources. Parties that adopt HydroMOR will have a competitive advantage through the liberation of legacy stockpiles of iron ore fines, slimes and mill scale while using very low-cost reductant in the form of lignite, improving efficiency and output from existing operations.”

“Prior cost estimates for the India pilot plant project were estimated at INR150 Cr (~AU$35M). This included costs for the development of a commercial scale Coldry facility along with, at that time, Matmor large pilot-scale equipment. The costs were apportioned approximately 60% Coldry and 40% Matmor. Given ECT’s continued R&D resulting in the shift from the original Matmor technology platform to the improved HydroMOR platform, and the planned commercial demonstration scale upgrades at our Bacchus Marsh Coldry plant, ECT now has a lot more options to consider in terms of the structure of any new project that may be pursued in India.”

At a high level some of these options are:

- Building the HydroMOR pilot-scale equipment at the steelmaker's site, along with a small-scale batch drying Coldry unit and ship lignite to that site from NLCIL.

- Build the HydroMOR pilot-scale equipment at the steelmaker's site in India and prepare all feedstock at the upgraded Bacchus Marsh Coldry plant and ship to India for testing.

- Fabricate the HydroMOR pilot-scale equipment in India and install it at Bacchus Marsh. Refine the designs in Australia using both local and India-sourced feedstock. Build a subsequent commercial demonstration HydroMOR plant in India.

Whilst not an exhaustive list of options, those stated above have some consistent components, notably:

- The project is not geographically constrained to the NLCIL site.

- NLCIL has the flexibility to be a supplier of lignite to the project, a project investment partner or a combination thereof.

- Privately-owned Indian steelmakers are likely to be quicker than government-owned steelmakers in the development of a new project deal.

- The development of a Coldry commercial demonstration plant in Australia may significantly reduce the capital costs required to test HydroMOR at the next scale point.

- There is still a strong appetite in India to develop innovative steelmaking technologies such as HydroMOR.

The Company looks forward to providing further updates on India activity in due course.

Background

Prior to June last year, the Company’s strategy was clear; start the construction of the much-anticipated India project and then move quickly to upgrade local facilities to support the techno-economic feasibility of the proposed Latrobe Valley project as well as serving as an ongoing test facility for the India project and further technology development of the Company’s diesel and hydrogen technologies, CDP and COHGen.

As previously announced, the India project didn’t proceed, and last September the Company released an update to its corporate strategy (see announcement 4 September 2019).

The basic premise is to monetise the technology and equipment developed to date to use operational earnings to advance the commercialisation of the Company’s technology suite.

ECT is presently focused on delivering its plant upgrade strategy, supported by the current Non-Renounceable Entitlement Offer (see announcement 6 December 2019) structured to raise a minimum of $1.41 million, which closes on 30 January 2020.

Successfully delivered, the plant upgrade will target net cashflows of $3 million per annum, providing the Company with a solid foundation to fund ongoing research, in addition to advancing project development.

The project development pipeline currently includes the proposed Latrobe Valley project, which seeks to deploy a large-scale Coldry plant to produce solid and liquid fuels for the domestic market, in addition to the proposed India project which seeks to deploy the Company’s Matmor (now HydroMOR) steelmaking process.

For further information, contact: Glenn Fozard – Chairman [email protected]